3.

Let’s face it, with traditional equities investing, most people lack the skills and access to information that would enable them to invest smartly.

The lack of skill and access to information deepens when Blockchain investments are involved. This creates a need for Blockchain-based mutual funds and hedge funds that help investors who do not have the time, skill and information to optimize their investments. Funds come with a certain trust level because investors believe professionals who understand the market and have more information than they have usually handle them. And since funds typically have their own skin in the game in that they make money based on the performance of the fund, investors feel a tad more comfortable.

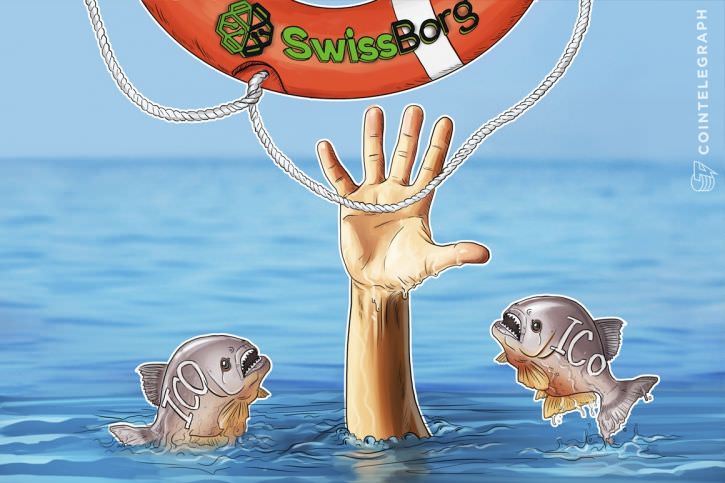

There are existing cryptofunds that are already doing their part in instilling confidence in the crypto-investment space, but there are still some things to fix in order to improve investor confidence. For instance, the fund management team usually, by default, owns a portion of the fund tokens. For an industry currently dealing with trust issues, this is a drawback because it creates the fear that founders are all about making money for themselves alone. There’s clearly a need for transparency and Swissborg aims to provide it by distributing all of its tokens to its network. In other words, the management team receives to token allocation, thereby, making the fund a bit more transparent.