Bitcoin just forked another coin, and its price has dropped from a high over $6,100 to about $5,700. Another fork is coming in November, and already some have wondered whether the bull run might be over, or whether it’s “just resting.” To answer that question, you need to figure out whether it’s possible to invest in Bitcoin or related currencies.

On that front, Aswath Damodaran has just written a piece reiterating his thesis that Bitcoin is a currency, not an asset, commodity, or collectible. As a result, its value is effectively whatever people are willing to pay for it. The government of South Korea appears to disagree, having just reiterated their position that it is a commodity. And, of course, some continue to call it a collectible comparable to tulips.

Damodaran’s analysis is too quick. That is why, I think, there continues to be controversy surrounding Bitcoin and related cryptocurrencies. Now to be clear I, like many in my generation, have learned a great deal from Damodaran about how to value securities. Still, his position misses important, basic features about Bitcoin and other cryptocurrencies. The two claims I take issue with are the following.

Claim 1: No cryptocurrency is an asset.

Claim 2: Bitcoin is a currency.

I am going to show that claim no. 1 is untrue and claim no. 2 is highly misleading.

These observations matter because together they show that it is possible to invest, and not just trade, in cryptocurrencies (broadly) and Bitcoin (in particular). The reason is that it does have a fundamental value that is distinct from whatever people are willing to pay. To explain, I’ll begin with what I think Damodaran and similar analyses get right, namely that some coins are commodities.

Why Ether is a Commodity

The following chart very briefly organizes why an item qualifies as for a specific class.

|

Class |

Rationale |

|

Asset |

Value from production or expected production of cash flows |

|

Commodity |

Value from raw material used to meet a (fundamental) need |

|

Currency |

No value, but can be used to denominate cash flows and act as a store of purchasing power |

|

Collectible |

Aesthetic or emotional value |

The Ethereum network, as I’ve explained in more depth here, uses Ether as “gas” to power the blockchain technology. Ownership of Ether is thus ownership of a virtual “raw material” to meet a need, namely the operation of the network. This is why Damodaran and the South Korean government agree of the commodity classification.

Now to generalize the point, one notes that any coin which powers a blockchain technology is thus a commodity. Since many (perhaps most) other coins do that, the greater part of the cryptocurrency world would appear to be commodity based. Insofar as it is possible to invest in commodities, then, it is possible to invest in these coins.

How to value these coins is important, and I’ve suggested (more detail here) that one could use a price to Metcalfe value to aid in identifying whether a coin is a bargain. The idea is simple, if one is attempting to gauge how much need there is for such a coin, then looking to the growth in its network (which is the the Metcalfe value does) is a fairly good idea.

Now let’s move on to cases where a coin is an asset.

Why Neo is an Asset

NEO is a quasi-competitor to Ether, developed for adoption by the Chinese authorities, and programmable in well-known languages, like Java. The idea is that it could carve out a space in China for initial coin offerings (ICOs), and appeal to developers who don’t want to learn another programming language for blockchain technology (as Ethereum requires).

Like Ether, NEO has “gas” that powers the blockchain technology. Unlike Ether, that gas is not the NEO coin (or more accurately: indexed to it). Rather there is another coin, called GAS, which is what actually powers the NEO network. What does NEO do then?

Well, it gives its owners two rights: first, you get to vote on NEO related matters, and second, you get a dividend that you can claim whenever you want. The rate of dividend payment is roughly 1 coin of GAS every eleven years. Stated differently, if you own 11 NEO coins, then you will get 1 GAS as a yearly dividend (again roughly, as the calculations vary a little in practice).

GAS is currently trading at about $18.30 a coin and NEO costs about $28.30 a coin. So you’ll need to spend about $311 to get an $18.30 dividend annually, which works out to about 5.9% That may not convince you to buy into NEO, but it does clearly demonstrate that NEO is an asset, not a commodity.

Damodaran’s first claim, that no cryptocurrencies are assets, is thus false in any substantive sense. One might quibble and argue that one is not paid in fiat currency, but a commodity, namely GAS, which one then trades for fiat money. But that would be analogous to arguing that the land a farmer owns is not an asset, because when he uses it to grow wheat, which he then sells for money. It follows that the right way to value NEO is by a discounted cashflow analysis.

Now let’s move onto Bitcoin, which I think is a mixed-class item.

Why Bitcoin is a Mixed-Class Item

Bitcoin’s stated use case is as a currency, though most people own it as a store of value, or as an item for trading. In Japan, Bitcoin is a legally recognized currency, even if other countries like the United States and South Korea view it as a commodity. As a result, it legally meets the definition of a currency.

But Bitcoin also has a variety of network functions which are difficult to characterize briefly or catalog completely (though they do exist and that is the important part). Here are a few of them.

- First, Bitcoin is often the only way to exchange with other coins. The Bittrex exchange, for example, is one of the few open to US clients which has a wide range of coins. In order to buy Ripple, for example, I had to go to Bittrex. Yet Bittrex only allows Bitcoin to other coin exchanges, not other coin-to-coin exchanges. In this indirect way, functioning as an intermediary, Bitcoin is thus functioning as the “gas” to the broader cryptocurrency world.

- A second, and similar case, is the way that most ICOs only accept one of two different coins for fundraising: Ether or Bitcoin. Again, Bitcoin is again functioning as the “gas” for the broader cryptocurrency network.

- Third, the major technological innovations by the Bitcoin core development team tend to be those that are institutionalized for the cryptocurrency world. The Lightning Network, for example, was first developed for Bitcoin and later served as the impetus for others to develop their own similar technology. Even the most recent Bitcoin fork is to be used as a sort of technological “sandbox” or “incubator” for new ideas. In this incubator capacity, then, Bitcoin is again propping up the great cryptocurrency world.

- Fourth, the investment infrastructure for cryptocurrencies, such as mining technology, is devoted largely to Bitcoin. As a result, the available technology for other coins tends to be constrained by how existing miners would be willing to repurpose their technology.

- The list goes on.

A reasonable response is to argue that these are not use cases internal to the Bitcoin technology, no matter how long my list is. My response is that such an analysis misses the point. The cryptocurrency world is being propped up by Bitcoin quite broadly, and so the fluctuations of other currencies in line with Bitcoin is a rational response to this dependency. Failing to recognize this broader role is a mistake in just the same way that failing to recognize how rainfall shortages will affect gain prices, which will (in turn) affect the price of beef. These considerations, then, point to an understanding of Bitcoin as a sort of commodity for the cryptocurrency network.

Finally, there is a way in which Bitcoin does produce cash flows, namely by “dividends.” The reason Bitcoin had a run-up from $4100 to $6100 was from the attempt by many to “cash in” on the most recent fork. When there is a technological update to Bitcoin, the blockchain forks, creating a new coin (Bitcoin Gold most recently). That new coin can then be sold on exchanges for money. Forks thus provide Bitcoin holds dividends. If, like me, you’ve owned Bitcoin since mid-summer, then you’ve probably made a 30% return by these forks on your initial buy. Admittedly, gauging the regularity of these pay-outs is difficult, but they do exist, and we are likely to see one or two a year for several years going forward.

When these broader points are taken together, it seems reasonable to classify Bitcoin as a mixed-class item: part currency, part commodity and part asset. This is why I hold that Damodaran’s second claim, that Bitcoin is a currency, is highly misleading.

But is the Bull “Just Resting?”

I suggested in the beginning that the answer turns in part on whether it is possible to invest in Bitcoin. I think you can, given the above. The other part of the answer turns on what you mean by a “dead bull.” Is a drop by 40%, which lasts a few months, a dead bull?

Here is how I’ve been thinking about the matter. Given the mixed status of Bitcoin, I suggested a while back that using a Price to Metcalfe Value (P/MV) ratio was the best indirect measure we have. The Metcalfe Value is a way to express the value of the underlying network of a technology a little like the book value of a firm, and using this method has identified bubbles in the past. Bitcoin might reasonably trade at a multiple to this value, as price shares often trade at a multiple of the book value of a company. When in 2014 Bitcoin was trading at 16x the Metcalfe value, it crashed back down (chart below scaled logarithmically, with green for dollars).

Source: My Own Chart; Data Source: blockchain.info.

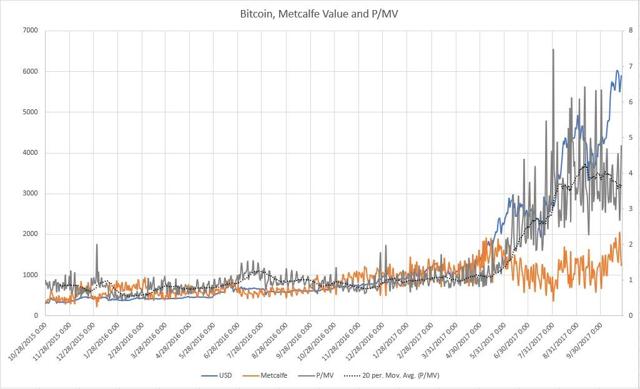

Recently, the P/MV spiked a little over 6x, while a few months ago it was at 1.3x (see below)

Source: My Own Chart; Data: Blockchain.info

You can see in this chart that the price of Bitcoin (in blue) has soared, but Metcalfe value (orange) of the network has remained at about $2000 a coin. This is a fast expansion in the multiple (grey), and not just in the size of the Bitcoin network. I’m worried, as a result, that this is irrational exuberance.

If the P/MV were to drop to a more reasonable level, Bitcoin should be trading at about $3900-$4100. That’s roughly a 40% drop from current prices (at $5700). I do think that by the end of 2018, however, given a 25% growth of the Bitcoin network, the coin should be worth perhaps $6400. Bitcoin might thus reasonably crash down to $3900 and then blast off to $6400 over the next 14 months.

You tell me whether that’s a dead bull.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I do own some Bitcoin, Ether, Neo, and Ripple.

Editor’s Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.