Netflix stock plummeted 11% out of the gate despite posting better-than-expected earnings in Q2. The reason? A colossal miss in subscriber growth, the lifeblood of the debt-ridden media giant. Now that Wall Street appears to be waking up to overvaluations, here are three tech stock bubbles – Beyond Meat, Uber, and Tesla – that might be next.

1. Beyond Meat: To Infinity and Beyond?

While you might not think Beyond Meat is a tech stock, think again. The company spends a fortune on R&D lab work to try and keep its burgers tasting like the real thing. Similar to Netflix, BYND faces a mass of competitors looking to piggyback off its success while also enduring an alarming cash burn.

Investors have gorged themselves on Beyond Meat (BYND) since its IPO this year. The feeding frenzy has lifted BYND from below $50 to as high as $200 per share. It currently trades just below $170, giving it a $10.2 billion valuation. When you consider that this company’s loss per share is -$4.68, clearly they must have some unique technology to justify an 11-figure market valuation. Well, to be honest, they don’t.

Beyond’s pea-protein-based burgers are an improvement on veggie or vegan burgers of yore, but you can buy an almost identical generic product from most stores. Add to the mix that giants like Tyson Foods are wading into the arena, and the possible bubble becomes clearer. Beyond Meat’s stock might not even be the only vegan play in town for much longer, as Impossible Foods will likely try and go public soon. Add the fact that the stock looks very overbought technically, and you have an explosive bearish cocktail.

2. Uber-The Netflix Of Rideshare

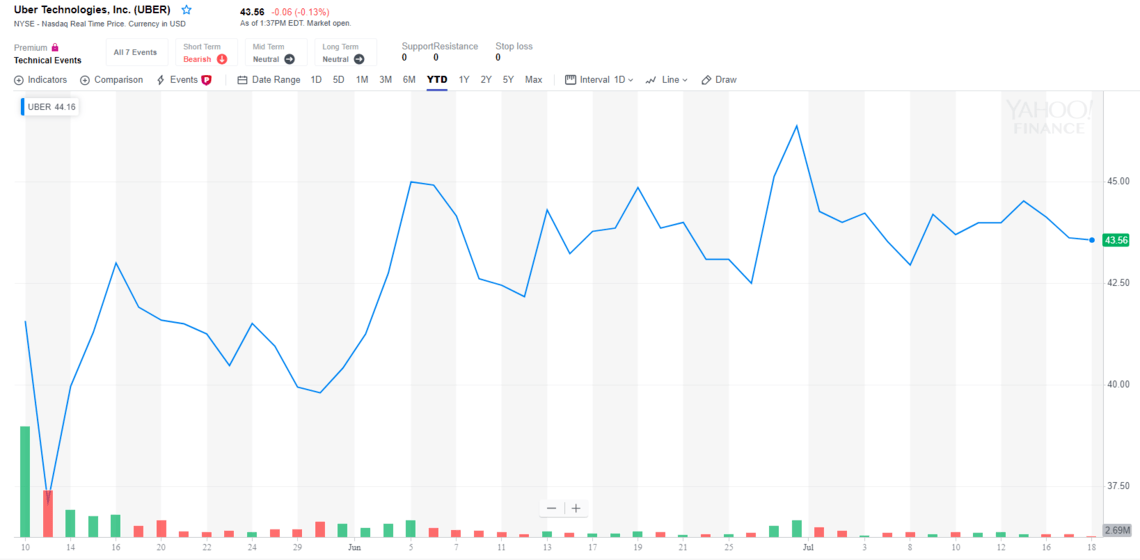

Uber had the opposite IPO experience from Beyond Meat. Its stock initially fell as low as $36. Now trading around $40, this is not an overbought stock. However, with a valuation of $74 billion and a complete disinterest in making money, Uber’s risky business model has all the hallmarks of the tech bubble of 2001. Desperately investing in self-driving technology and expanding into as many countries as possible, it’s clear Uber wants world domination. Just like Netflix, Uber has no way to keep customers loyal and must pursue this innovate-or-die process to try and separate itself from competitors that offer extremely similar services.

If ever there was a sign of delusional aspirations, it was Uber’s recent air-taxi video. Let’s see what the FAA has to say about thousands of flying vehicles swirling around Manhattan with apparently no pre-boarding security. This ambition is probably what is keeping bullish speculation alive, but if global risk sentiment sours, companies with lopsided balance sheets like Uber could definitely be the worst hit.

3. Tesla Stock: Shocking Demand

Ahh Tesla. The mercurial EV stock has been looking like Lazarus lately, as it has soared to $250 since hitting $180 at its lows this year. Given that this was down more than 40% from its peak, you’d be forgiven for thinking that the bubble already burst. There have certainly been better headlines for Tesla, as it appears to be scaling production of its Model 3 nicely. Despite this, TSLA boasts a loss per share of -$5.69. Considering that Netflix could drop 12% with positive EPS of $2.54, it’s obvious why so many analysts are bearish TSLA given the company’s debt load.

With plenty of outstanding liabilities and the impending avalanche of competition that is coming from mainstream auto-manufacturers, there are distinct challenges ahead. Perhaps the clearest weakness in Tesla’s stock price is the expiration of many government handouts supporting electric vehicle purchases. Subsidies have been artificially boosting demand for some time. This issue is not insurmountable from a stock perspective if Elon Musk can keep selling his cars. Nonetheless, you can’t sail this close to the wind and not risk falling victim to a credit crunch.

The amount of bearish speculation in Tesla should tell you all you need to know about Wall Street’s favorite short.