Mimesis Capital: Inside The Event Horizon, Report #15

Why Does Bitcoin’s Price Make Random, Sudden Downward Moves?

A common knock on bitcoin is that it is “too volatile.”

There is no denying that bitcoin is a volatile asset. Its price action supports this conclusion on nearly all time frames (including minute, hour, daily, and yearly).

However, volatility isn’t necessarily a bad thing. In fact, volatility creates opportunity.

Over long time horizons (4+ years), bitcoin’s volatility has been mainly to the upside. Using this longer time horizon helps to eliminate the noise and focus on the signal.

Volatility and return can be assessed using something called the Sharpe ratio, which measures risk-adjusted return. The Sharpe ratio is the result of dividing the asset’s return by its risk/volatility over a 4-year HODL period.

Bitcoin’s Sharpe ratio has been higher than that of every other asset class throughout its entire existence. This is one of Wall Street’s favorite financial metrics, and it screams, “Buy bitcoin,” as it shows that the return of holding bitcoin has more than compensated holders for its historical level of downside volatility.

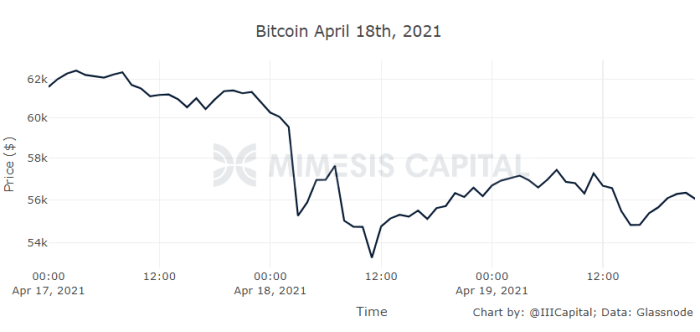

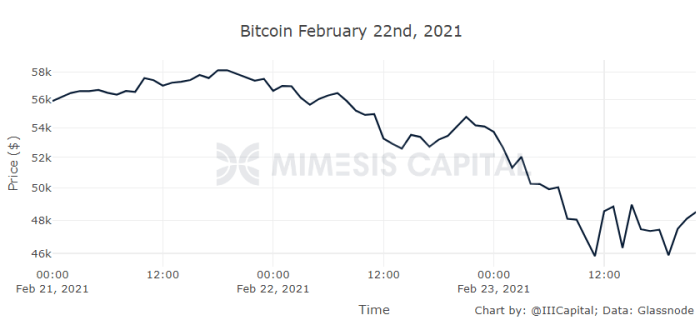

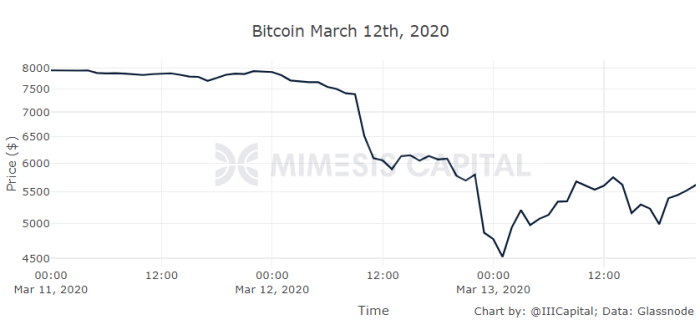

Large, Quick Downward Moves

Why does bitcoin have such large, sudden downward price moves? What is causing these massive corrections in such short times?

February 22nd, 2021

March 12th, 2020

Unlike equities (stocks), which tend to be traded aggressively on earnings days (days when companies’ performance and future guidance fundamentally change), bitcoin tends to be traded aggressively on seemingly random days.

This strange phenomenon tends to confuse traditional commentators and journalists as they struggle to find any news piece that could have affected the price so drastically.

Eventually, someone finds some possible explanation, and it immediately gets circulated as a result of confirmation bias.

Examples:

- “Bitcoin fell 10% because of the Biden tax hikes”

- “Bitcoin fell 10% because of a (false) exchange inflow of 10,000 BTC”

- “Bitcoin fell 10% because Yellen is pushing for an 80% capital gains tax on crypto” (fake news)

Although a small number of individuals may be placing buy or sell orders based on one-off news stories, they likely aren’t the sole driver of the sudden bitcoin price crashes that we regularly see.

In reality, many people retweeting and spreading the news that bitcoin’s price crashed because of X are simply being “Fooled by Randomness.”

Leverage Liquidations

Although X may be one of many catalysts, the large downward moves are often driven by excessive leverage in the system.

This may confuse some people because by definition, for every buyer of a futures or perpetual swap contract, there must be a seller. However, the prices of those contracts change based on the market’s balance between longs and shorts.

For example, a funding rate is charged that helps exchanges to keep the perpetual swap price in line with the spot price. If the general market sentiment leans long, then the funding rate likely results in longs paying shorts every 8 hours. This is why bitcoin futures contracts trade in contango during a bull market.

Parker Lews from Unchained Capital explains leverage liquidations well by stating that “Bitcoin eliminates imbalance.”

If there are too many leveraged longs on bitcoin without simultaneous buying pressure in the spot market, the current price may temporarily be unsustainable.

These leverage liquidations result in an ugly negative feedback loop:

- Price falls.

- Highly leveraged longs get liquidated (forced sellers).

- Price falls further.

- Less-leveraged longs get liquidated (more forced sellers).

- Traders see falling prices and jump on the trend.

- Price falls.

- Repeat until the fragility of systemic leverage is eliminated.

This imbalance, driven by excessive leverage, results in volatility. This volatility results in coins getting transferred from weak hands to strong hands that understand bitcoin. After weak hands sell, the price must adjust to the new equilibrium.

A new base of strong holders is then built at a more sustainable price level, and then bitcoin’s parabolic bull run continues, as it has for more than a decade. This is all due to individuals game theoretically converging on Bitcoin as a Schelling point because of its superior monetary properties.

Contango? Hyperbitcoinization?

Some may ask, if excess leverage is a key reason why these sudden downward price moves occur, how can the futures curve contango be good for Bitcoin, especially if the curve is driven by the demand to place leveraged long bitcoin purchases?

First, the contango basis trade still exists, and it is profitable for a low-risk USD-denominated trader to buy spot, sell futures, and capture the spread. With that said, if the curve gets too high without enough capital coming in to execute the basis trade or buy spot, the contango/funding rate could get unsustainably high.

If the funding rate or contango curve gets too high without significant buying pressure in the spot market driving up the price, then the price could be driven up on a fragile base of leveraged longs paying high funding rates. If so, it could potentially crash violently.

This is a guest post by Mimesis Capital. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.